Sustainable

Energy Transitions: the energy trap and the currency option

By Sgouris Sgouridis

Energy is a sine

qua non for any self-organizing system and yet it features surprisingly in

the margins of what passes for mainstream, long-term planning of our societies.

We have grown critically dependent on cheap, energy-dense fossil fuels but

their price and climate externalities have been rising as we are nearing peak

production. This necessitates a transition to renewable energy sources. This

post addresses the implicit physical and financial requirements if this

Sustainable Energy Transition (SET) is to happen as a result of a planned, and

seamless transformation, and not forced upon our societies. More specifically,

we propose five principles (three limiting and two normative) that can be used

as a guide for the transition. On the physical side, based on a quantified

application of the fourth principle, we demonstrate the need to increase the

amount of investment in renewable energy resources by one order of magnitude to

achieve a SET within the IPCC carbon budget. Similarly, starting from the fifth

principle, we present a concept of an energy currency that could mobilize

resources to achieve this target while better aligning the monetary system with

the biosphere limits.

First hand accounts from the situation in war zones

(more recently Syria) refer to the seeming ease of acceptance of very drastic

changes in the energy situation -people continue to live their lives moving

from a 24/7 grid-access to 3-hour, diesel generator-based households without

expressing a sense of severe deprivation. Nevertheless, this acceptance comes

in the context of a much larger crisis and the risks of war. It is possible

that this situation could be a preview for how the vast majority of humanity

might deal with a forced depowering as fossil fuels become increasingly

expensive and the infrastructure for alternatives (renewables, higher

efficiency equipment) becomes impossible to obtain as the available energy resources

would be prioritized for primary needs (food & shelter) – a situation which

could be described as a an energy trap. The question is not whether this would

be the future under BAU but rather when - as we show that even allowing for

full use of fossil resource reserves (and frying the planet in the process) it

would still require a fourfold increase in the investment rate for renewables

to achieve an energy transition of shorts.

The first two sections provide an introduction for

the energy view of the economy and a basic model of it to set the stage for the

discussion of the SET principles and their corollaries. Perhaps readers of this

blog may want to skip the introductory section as it may seem trivial to them.

Introduction: From Flows to Stocks and Back Again

One of the main problems in discussing the potential

for a future energy transition is that in fact, on a global scale, we never

really completed one since moving from being hunter gatherers to farmers. And

yet one of the great civilizational challenges that we are currently facing

without explicitly recognizing, is exactly how to pull such a transition off.

The challenge sounds simple: transition completely from a fossil fuel based

society to one based on renewable energy. Nevertheless it requires a shift of

the economic paradigm because the energy metabolism that it relies on is

shifting. It needs to revert back from an economy of stocks to an economy of

flows.

Up until three centuries ago, societal energy

metabolism was overwhelmingly based on the capacity of the land (stock) to

capture solar energy (flow) through agricultural photosynthesis. As a result a

maximum power (flow) was limiting what society could use -determined primarily

by the stock of land under production/exploitation. The amount of primary

energy society used in a given year was on average* proportional to the flow

of energy it received on its land for that period hence the name economy of

flows. (*granaries allowed for a small reserve to adjust for crop

fluctuations).

With fossil fuels, suddenly a stock of solar energy

cumulated over millenia became available. This stock being several orders of

magnitude greater than the annual energy requirement of society, effectively

permitted energy to become something free for the taking basically at the

marginal cost of extraction. This cost of extraction (determined in energy

terms by the inverse of the energy return on energy invested - EROEI) was very

much lower than for agriculture. Same as oxygen in the air we breathe, if an

economic process needed additional energy, those huge reserves were there to

provide it. We are able to afford levels of energy per capita that were unheard

of for kings of the past to about half of humanity, exponentially raise

population levels, and wage massively destructive wars and then recover in

a few years. Given that humans could not metabolize fossil resources directly,

we found ways to massively boost our agriculture productivity using

them.

This resulted in exponential growth taking over from

linear. In the early stages the two are very difficult to distinguish but as

time progresses the differences become staggering as the king who decided to

pay the inventor of chess in the apocryphal story realized. In many ways we

acted as a species that won the cosmic energy lottery. But the prize is finite:

stocks in the form of oil, gas, and coal reserves. The fossil-fuel economy is

an economy based on the existence of an abundant stock - the limits to

available energy is not the supply but the rate at which we can use the

resource - the demand. This economy of stocks is only possible as long as the

rate at which energy extraction can expand is higher than the rate at which the

economy itself expands. Once the two rates swithc, the paradigm fails. And the

arduous road back to an economy at equilibrium with its ecosystem natural flows

needs to commence.

In understanding these dynamics, it is critical to

realize that the energy system that is underpinning our society is its

lifeline. All economists realize that value is dependent on scarcity - when

oxygen or water are abundant markets put a price of zero on them, yet when

scarce all wealth on earth would be gladly exchanged for a breath or a drop.

The same is explaining the seeming paradox of why energy is only a small

percentage of the GDP, yet without energy our GDP would have been exactly zero.

Conditioned by three centuries of increasing abundance, neither our mainstream

economic theory, nor our intuition, is prepared to accept the longer-term

implications of this fact for a society dependent on a depleting resource. This

unwillingness to value the depleting resource that seems to be the current

limiting factor in our economies may have multiple causes which are further

discussed in the last section.

Modeling the Energy Metabolism of the Economy as a

System of Systems

Before proceeding further though, we need to provide

a context to help visualize/conceptualize the complex interactions present in

the energy metabolism of our economy. It is a useful abstraction to consider

the energy system as consisting of four subsystems or views: fossil fuel

extraction, renewable energy installation, energy-utilizing capital, and

demographics. We provide a brief, stylized, description of each of the first

three as a model for understanding the approach we are taking on mapping the

society’s energy metabolism. We leave demographics aside because of their

significant inertia and strong dependence on social norms and political

priorities that can be developed outside the energy system dynamics.

Fundamentally, the fossil fuel extraction subsystem

is comprised of two types of stocks: the fossil resource reserves and the stock

of machinery that is used for its exploitation. Fossil fuel EROEI is, for the

most part, operational - i.e. the energy we invest in their extraction is

recovered in the EROEI multiple very shortly - in a generational timeframe

instantaneously. As a result, fossil resource extraction is governed by three

main dynamics at play. While reserves are plenty and EROEI high, fossil

resources are perceived as abundant, and with the equivalent of an energy

bonanza the demand for them grows exponentially. This is a reinforcing behavior

that any self-organizing system (see yeast) that has access to an abundant

energy source will inevitably take as long as it is not limited in any other

way. On the other hand, fossil fuel resources are becoming progressively harder

to extract as the reserves are being depleted increasing their -energy and

monetary - cost (delayed balancing feedback). In response to this, technology

development provides a counterbalance increasing the efficiency of the

extraction process (e.g. horizontal drilling and enhanced oil recovery

techniques). While this interplay would be rather difficult to model and calibrate

for each resource, it turns out that in aggregate it has exhibited, pretty

consistently, a pattern known as the Hubbert curve.

Most forms of renewable energy (with the exception of

biomass) are, unlike fossil resources, capital intensive. They require an

upfront investment (in energy and financial terms) to which they provide

returns over a long lifetime (around 30 years for most projects). In back of

the envelope math, if we invest X amount of energy in developing a renewable

energy resource, we will be receiving annually X * EROEI / Lifetime. This

creates a very different dynamic - if we need a certain amount of energy a

decade from now, we need to be investing today so that the cumulative

investment allows us to reach the desired level in the future - renewables

cannot provide instant gratification. The amount of energy investment that goes

into the RE generation infrastructure can be presented as a ratio of the

investment in renewables in a given year over the total amount of energy

available on that same year - the renewable energy investment ratio (epsilon).

On the consuming side, energy demand is dependent to

a first degree on the availability of the energy utilizing capital - the

infrastructure and equipment (roads, cars, buildings, boilers etc.) that

transform primary energy into useful services. This energy-utilizing capital is

characterized by two main attributes: utilization rate and efficiency. The

infrastructure’s rated power is much higher than average consumption - as an

example, the power of cars produced in just one year is ~10TW while

the global average power consumption is ~16TW which gives a sense of the very

low utilization rates but also of the scale of the productive capacity of the

current economic system. The utilization rate is, as basic economics suggest,

dependent on the price of energy - at lower prices utilization increases and

spurs the demand for expanding infrastructure and increase the stock of

energy-consuming capital. The price of energy should have been, in theory,

reflecting the opportunity cost of depletion but, given the timeframes and

institutional structures involved, in reality prices reflect only the marginal

cost of extraction (global in the fungible oil market) or regional (in the

cases of natural gas or coal). So from an energy metabolism perspective, the

price of energy to society is the amount of energy that is reserved for

producing it (i.e. it would directly correlate to the inverse EROEI for fossil

and the epsilon for RE). One therefore would expect that as the “cost” of

energy increases, its demand should be reduced (a balancing loop). But this is

counteracted by other balancing effects: as energy costs rise, there is a

strong push to increase the efficiency of the energy utilizing capital (with

significant delays usually) through technology improvement. Another alternative

is to mask the effect of costs through debt - a factor we examine again in the

next section.

So far this picture is familiar to any students of

ecological economics that have followed the ideas of Daly, Georgescou-Rogen, Hall

and others. This article though presents two novel perspectives: first how

should we define the shape and form of the sustainable energy transition (SET)

- i.e. the dynamics of this transition and second how can we modify our

financial system and the way we create money in order to conform with the

realities of a finite planet (a closed economy in an open thermodynamic

system).

Five Propositions for Sustainable Energy Transitions

(based on Sgouridis & Csala 2014 )

It is always good to start with a definition to

create the common basis for understanding and judging an idea. In this case, I

will define SET as:

a controlled process that leads an

advanced, technical society to replace all major fossil fuel primary energy

inputs with sustainably renewable resources while maintaining a sufficient

final energy service level per capita.

As definitions are wont to be, it tries to capture a

lot of concepts laconically. But the key words are “controlled”, “technical”,

“all” and “sufficient”. The ideas conveyed indicate that the transition should

be smooth and not associated with dramatic social dislocation (controlled). It should

allow for society to at least maintain its technological capabilities

(technical), and at the level of the individual meet a certain threshold of

final energy availability (sufficient).

Knowing that the transition will be complete when

practically all fossil fuels are replaced, we can try to backcast the evolution

of the transition to the current energy situation. In this exercise, it is

instructive to take an energy metabolism perspective. This approach has several

advantages: first it focuses on the net energy availability for society

In order for this transition to be indeed

“sustainable" we would need to concern ourselves with each of the three

sustainability pillars (environmental, social, economic). Extending Daly’s

ideas, we propose five principles that need to be met - de

minimis - for a SET to be successful.

The five SET principles can be stated as

follows:

I.The rate of pollution emissions is less

than the ecosystem assimilative capacity.

II.Renewable energy generation does not

exceed the long-run ecosystem carrying capacity nor irreparably compromises it.

III.Per capita available energy remains

above the minimum level required to satisfy societal needs at any point during

SET and without disruptive discontinuity in its rate of change.

IV.The investment rate for the

installation of renewable generation and consumption capital stock is

sufficient to create a sustainable long-term renewable energy supply basis

before the non-renewable safely recoverable resource is exhausted.

V. Future consumption commitment (i.e.

debt issuance) is coupled to and limited by future energy availability.

The first two principles address the environmental

aspect (neither fossil nor renewables should impact the environment irreparably

within a human generation). The third addresses the social aspect ensuring that

(i) a minimum level of available energy is available, and (ii) the rate of

change in energy availability is not so drastic that it creates breakdown of

social support systems. A direct corollary of this is that a more equal society

faces an easier SET task than an unequal one. Finally, the last two principles

address economic sustainability (physical and financial). P.IV, a variant of

the Hartwick rule in economic literature, ensures that the rate of investment

in renewable energy is sufficient to compensate for the drawdown of the fossil

fuel supply while, P.V makes the connection between debt issuance and the

availability of energy to service that debt in the future.

Viewed from a normative angle, the first three

principles act as constraints of the transition function - the first gives an

upper limit in the amount of fossil energy available, the second puts a limit

in the amount of renewables that can be installed, the third provides a lower

bound on the per capita energy availability (and of its first derivative during

the transition). The latter two though are prescriptive and actionable - they

offer a quantifiable approach to estimate the minimum energy investment in

renewable energy and the maximum debt that can be extended for that level of

investment.

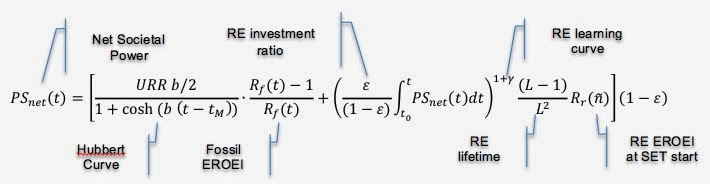

Focusing on the physical side, we can essentially

create an equation that ties the renewable energy investment ratio (epsilon) to

net societal energy availability which can be seen below (derivation in the

paper and supplement):

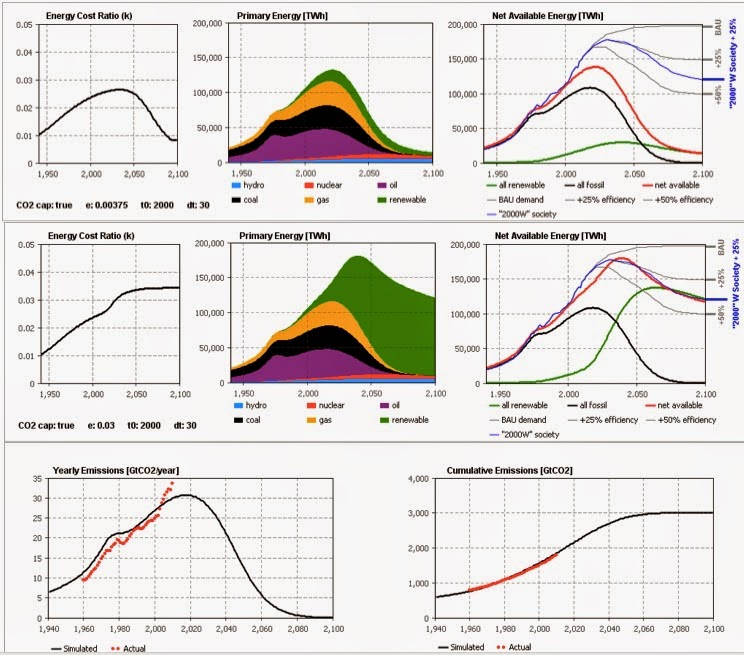

This recursive equation can be solved numerically

(through simulation) or analytically (harder). Below we provide, as a starting

point of the discussion, a comparison of the evolution of future energy

availability under the following scenarios. As typical of energy transitions

(and to meet the discontinuity constraints of Principle III), we assume that it

takes thirty years to change epsilon from its current value of around 0.25% (we

actually assume 0.375% for this model) to the “target” value and simply compare

energy availability with population dynamics in the next two graphs.

Carbon Uncapped

Emissions Dynamics (planet fries) – Requires 4x acceleration of RE investment

ratio to maintain energy availability at 2100

Carbon capped Emissions

Dynamics (planet 50% chances of staying with 2C) – Requires 8x acceleration of

RE investment ratio to maintain energy availability at 2100

The results are starkly clear: if we allow fossil

fuels to run their course, we will need to increase our rate of investment in

renewables fourfold. If we decide to save the climate and adhere to the IPCC

recommendations of no more than 3010 anthropogenic Gt CO2 in the atmosphere by

2100 for having a 50% chance of remaining below 2C by the end of the century

(which, apropos, is still the moral equivalent of loading a

revolver with three bullets and playing Russian roulette with your

grandchildren) we need an eight-fold increase of the epsilon rate. Of course,

there are key sensitive assumptions involved like the EROEI of renewables which

in the scenarios shown starts at 20 and increases with the installations -

readers are welcome to enter their own assumptions in our model (http://www.runthemodel.com/models/1418/)

- yet we believe that our choices are neither conservative nor aggressive and

we intend to enhance the simulation’s resolution by disaggregating specific

renewable energy technologies as we did for fossil fuels.

Bringing the Financial System Back to (physical)

Reality: The Case for an Energy Currency

(based on Sgouridis 2014)

Internalizing the civilizational nature of SET is

necessary but will not be sufficient to overcome the significant coordination

problems involved - either on a regional or a global scale. As was

alluded earlier, there are multiple factors at play. Cognitive psychology

has repeatedly shown the severe discounting of the future that most

(western-ized) humans exhibit. Olsonian capture of key regulatory processes

through lobby groups and election influence by moneyed interests through media

control are also shown to be widespread. There is significant inertia in the

habitual and systemic components of everyday behavior - even if we wanted to

change our behavior, it requires a rebel spirit to go against ingrained norms and

without the right infrastructure some choices may be impossible (e.g.

walkability and public transport in US suburbs). But all these factors, are in

the end reflection of the fundamental economic reality - the root obstacle lies

in the disconnect between financial and physical economics.

The current financialized economy is the result of a

reinforcing process in which wealth seems to become increasingly abstract and

with nominal values exceeding the productive capacity of the planet. To a large

extent this is another artifact of the ability to harness energy at will.

Before the industrial revolution, societies tended to grow at much slower pace

and when they did enter periods of “irrational exuberance” and debt

overextension, jubilees, revolutions, migration, or wars managed the debt

write-offs. This past three-hundred years though have probably seen the only

time in history where continuous economic growth has allowed most of the debt

issued to be repaid. It should be clear by now, that the ability to expand the

economy at a rate sufficient to repay debt (collectively) is only made possible

by the ability to expand the energy source to fuel the expansion. As fossil

fuels peak, we reenter the dynamics of an economy of flows and an alternative

path to financialization will be needed.

If we revisit Principle V, we can see that in a post-peak economy, the ability to extend debt (that in aggregate could reasonably be expected to be repaid) would depend on the future energy availability and the rate at which energy use becomes more efficient. It is possible therefore to write this equation for our closed earthship economy for post-peak fossil as we did for P-IV. It would be written as:

This equation ties the amount that new debt a society

can be expected to issue to the same renewable energy investment ratio - if the

debt to GWP ratio remains below this bound, it would reduce the chances for a

financial crisis in the future to wipe off unpayable debt.

Combining the implications of the two SET principles

and their resulting equations, it becomes clear that in order to set in motion

an adequate SET we need to control both the financial system and rapidly

increase the renewable energy investment ratio. An ideal option would harness

the two in a positively reinforcing dynamic. Realizing that debt is, by far,

the predominant mechanism for increasing the monetary supply, then exploring

the idea of an energy currency system becomes a logical inference.

There are many flavors an energy currency system

could take. I distinguish two basic types: a system of energy credits, and one

where debt issuance (and hence monetary supply) is in part or in its entirety

adjusted based on the energy/debt equation above.

The first type (and the one more likely to be

implemented earlier) can start from the bottom-up. Local and regional

complementary currencies based on energy can be fairly easily introduced to

support local economies that have specific energy limits. As described also in Sgouridisand Kennedy 2009, energy credits are issued in advance (similar to prepaid phone credits) in a

way that they represent the available (or targeted) energy supply for the

issuance period. As citizens and companies consume energy services they

withdraw from their allotment. In order to avoid either hoarding or imbalanced

front-heavy consumption, the credits should be issued at fairly short intervals

(daily/weekly) and expire thereafter. An asymmetric market for those credits

can support both of these goals and adjust demand to the actual energy supply.

This market operates by allowing users to sell their credits to the market if

they find the spot price attractive and are willing to adjust their

consumption. The spot price is generated algorithmically by comparing the

actual cumulative energy curve to the anticipated cumulative curve and

increasing (reducing) the price if the actual demand exceeds (is lower than)

the anticipated one in an attempt to correct the divergence. A key part of the

system is the existence of energy futures (which could act as yield bearing,

maturing investments) when an investor decides to invest in future renewable

energy generation. Energy futures would eventually mature and provide as yield

a certain amount of normal energy credits.

It is possible that if a number of such energy credit

systems emerge, then the futures could act as a substitute (better alternative)

to fiat currencies presenting a bottom-up path to an energy currency system.

Alternatively, a top-down path of energy currency

institutionalization is also possible if the political will to effectively

control monetary supply materializes - perhaps as a result of an ongoing

crisis. In theory, there are several ways to control debt issuance by

governments but none that is consistently effective (even in a controlled

economy like China’s) as bank-issued debt tends to be either more (fueling

bubbles) or less (strangling the productive economy) than desired. This problem

was noticed in the Great Depression, and a proposal known as the Chicago Plan

was put forward by a group of economists spearheaded by Irving Fisher. The idea

that bank-issued debt should be centrally controlled and fully regulated if it

does not utilize investment savings (i.e. deferred consumption) is regaining

ground led by IMF economist Michael Kumhoff.

The question though of how much debt to extend

remains unclear - what should be the desired level of debt that would allow an

economy the right growth? My thesis is that in a post-peak fossil fuel society,

it should be governed exactly by the energy/debt equation. If that becomes the

case, financial capital suddenly has a clear case to invest in renewable energy

generation so that the amount of extendable credit available increases (the

only way of exercising leverage of capital in the financial markets under the

Chicago Plan). It should be fairly trivial to tie some preferential terms and

prioritize the investors active in the physical energy markets for access to

debt to make this a reinforcing loop. Of course, it might be possible that the

energy market could overheat and exceed the desired levels of investment but

this is still controllable by the central bank authority that could preset

maximum limits.

Concluding Thoughts on Defusing the Energy Trap

While the targets of a carbon budget and the perils

of a peak in fossil fuels have been repeatedly discussed, a coherent,

systematic look at the energy economy system allowed us to relate the rate at

which we need to invest energy in building the renewable energy infrastructure

with social, environmental and economic requirements and constraints. It is

clear that the carbon constraints are more binding than the depletion rates but

in either case, a significant acceleration in the RE infrastructure buildout is

necessary if we are to avoid the energy trap. Our debt-based financial system

still acts as an additional mask of the depletion of easily accessible fossil fuels

and if we maintain it intact in the future, it will act as a break in the

efforts to reversing the decline in energy availability. A preview of how this

operates can be seen today in the countries of the European South - especially

Greece. The essence is that once the decline in energy availability cannot be

masked by debt, infrastructure investment will freeze further and the focus

will be addressing more pressing needs of day to day survival.

Our estimate for the appropriate rate of epsilon (the

renewable energy investment ratio) in a carbon-capped scenario (we should

accelerate from the current 0.3% to 3% of all available energy being used for

such investment) - this is dependent on the assumptions: that the current

average RE EROEI is 20 and will increase in the future, that energy efficiency

will increase the available final per capita energy by almost 50% and that the

energy needs of the global citizen will be stable to 2000W.

Any estimate done using the SET principles is a

conservative estimate. The SET principles assume that RE is perfect substitute

for fossil - basically we assume that all energy-utilizing capital investment

is done in ways that will allow the use of renewables. If this investment is

delayed or requires higher investment than the replacement of the existing

infrastructure would have, then additional energy would be needed to be able to

build these rail lines, and electric vehicle batteries and insulated buildings.

Another direct implication is that since RE is mostly variable, there is

possibility for perfect storage (i.e. no waste in curtailment of energy

supply). Since, even with extensive storage and very flexible demand side

management it would be likely that some energy will be wasted or at best used

at much lower efficiencies than average. Thirdly, if we desire to meet the

social development goal of providing 2000W per person, then the energy supply

estimate is for an equal society - our unequal one, would therefore require a

much larger primary energy supply to be able to provide 2000W as a minimum

basic. Finally, there is less discretionary energy than we assume here as the

food production system is a significant user of energy that will need to

increase to support population increases.

Even if the dream for a viable fusion reactor becomes

real (which I personally think is rather unlikely in the critical timeframes

ahead - i.e. 5 decades), ramping up such extremely complex energy system in a

society with declining energy resources would be very difficult if not impossible.

Even when it comes down to simpler distributed renewable energy systems,

harnessing the financial system to prevent excessive debt and incentivize the

right type of investment can be done using the concept of the energy

currency.

No comments:

Post a Comment